In the 21st-century digital economy, semiconductors are the foundational “brains” enabling everything from smartphones and electric cars to AI and 5G infrastructure. As global supply chains faced disruptive shocks in recent years, India has set its sights on not just reducing chip import dependence but also becoming a leading player in the world’s semiconductor industry. Backed by multi-billion-dollar incentives, foreign collaborations, and rapid market demand, the question on everyone’s mind is: Can India truly emerge as a global semiconductor innovation hub?

The Scale of India’s Semiconductor Ambition

Historic Investments and Government Strategy

India’s journey toward semiconductor self-reliance gained serious momentum with the approval of the India Semiconductor Mission (ISM) in 2021, which allocated ₹76,000 crore (over $10 billion) to foster a world-class chip ecosystem through 2025 and beyond. According to India’s Ministry of Electronics and IT, the program includes direct financial support for chip fabrication (fab) plants, display fabs, assembly and testing units, and chip design-linked incentives.

Under this mission, the government offers up to 50% capital expenditure incentives for semiconductor fabs across all technology nodes making the policy “extremely competitive” globally and helping draw in heavyweights like Foxconn, Micron, Tata, and HCL. As per the Semicon India program, more than five major chip manufacturing and assembly facilities are now being built on Indian soil, with cumulative investments exceeding ₹1.52 lakh crore (around $18 billion).

Global Aspirations Backed by Market Demand

India’s electronics market is already one of the world’s fastest growing. More strikingly, electronics constitute one of India’s largest import bills second only to energy making domestic chip production a pressing economic and strategic target.

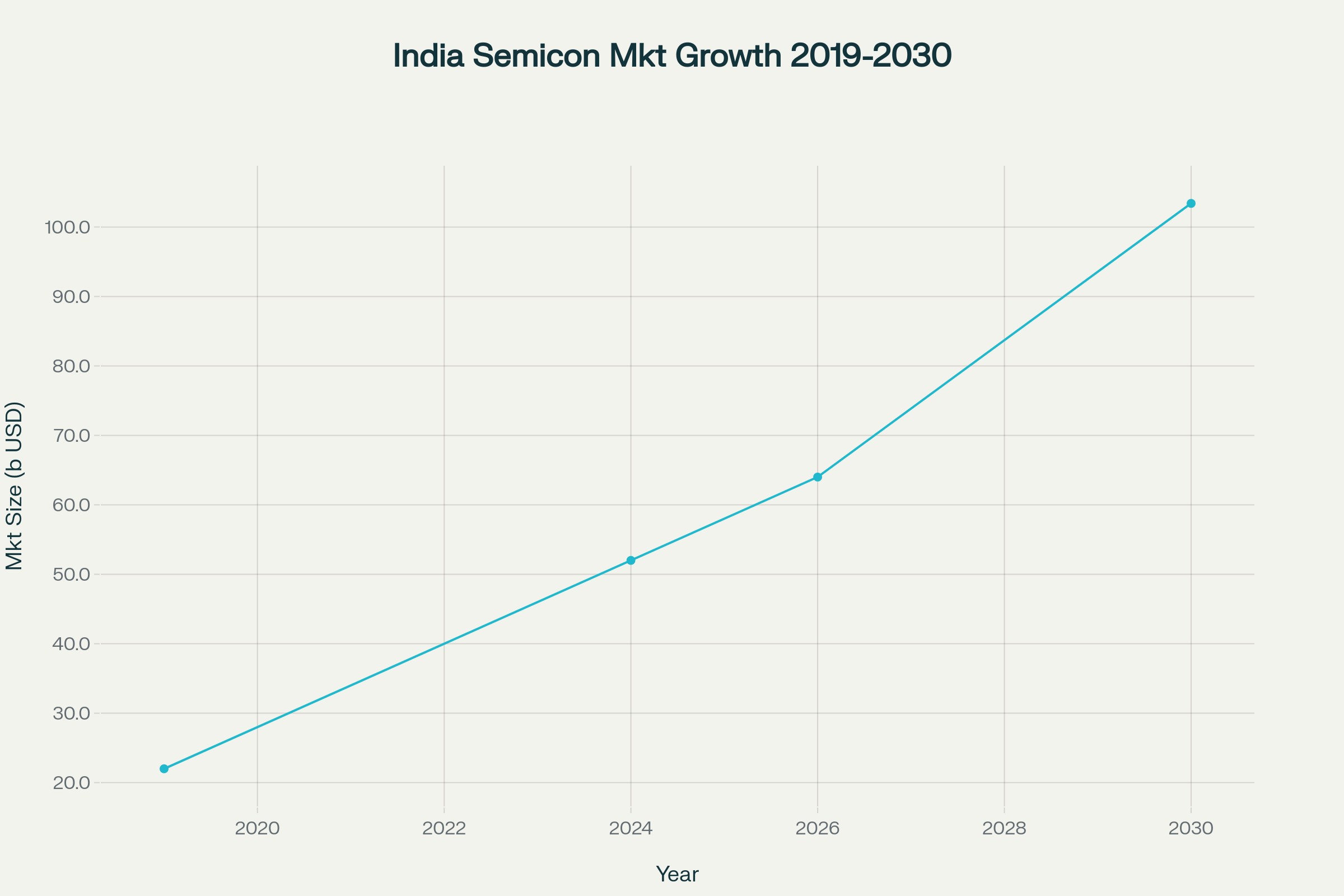

As per a 2024 India Electronics and Semiconductor Association (IESA) report, India’s semiconductor market is expected to surge from $52 billion in 2024 to a projected $103.4 billion by 2030. Consumption was just $22 billion in 2019, highlighting a compound annual growth rate (CAGR) of over 16% among the fastest globally. This growth is fed by explosive demand for chips in mobile devices, telecom, automotive, and renewable energy sectors.

India’s semiconductor consumption is set to account for approximately 10% of global demand by 2030, up from 4% in 2022.

Charting the Trajectory: India’s Semiconductor Market Growth

India Semiconductor Market Growth from 2019 to 2030 in billion USD

Major Policies and Incentives: The Pillars of India’s Semi Revolution

The Semicon India Mission

The flagship Semicon India Mission acts as India’s primary vehicle for chip ecosystem development. As per official policy statements, it focuses on four pillars:

- Financial Incentives: Up to 50% capital support for chip fabs, packaging, and component plants.

- R&D and Design: Targeted funding and purchase preference for domestic innovation, training, and R&D.

- Export Assistance: Opportunities and tax breaks for Indian-designed chips globally.

- Cluster Development: State-level support and infrastructure (clean water, reliable power, logistics) in tech-friendly regions like Gujarat, Uttar Pradesh, Karnataka, and Tamil Nadu.

Large-scale investments ₹76,000 crore for the overall program; ₹1.5 lakh crore approved projects (as of 2025); and dedicated new policies (Semicon 2.0) now put India squarely on the global semiconductor map.

Attracting Global and Local Players

India’s push is underpinned by high-profile partnerships and MOUs signed with the USA, EU, Japan, and Singapore for R&D, workforce skilling, and supply chain integration.

Confirmed projects include:

- Micron’s $825 million Assembly & Testing facility in Gujarat

- HCL-Foxconn joint fab in Uttar Pradesh (₹37 billion) with a design capacity of 20,000 wafers/month focused on display driver chips for electronics and automotive

- Tata Electronics and Adani significant investments in upstream supply chains

The Talent Engine: India’s Chip Workforce and Design Ecosystem

Human Capital Strength

India is not just building fabs but turbocharging the global chip-design workforce. As per SEMI-IESA and government estimates, India contributes around 20% of the world’s semiconductor design talent, accounting for over 35,000 engineers dedicated to chip R&D and supporting 2,000+ design startups and SMEs. The government has also pledged to train 85,000+ new semiconductor engineers over the next decade.

Start-ups, Innovation, and the Value Chain

Indian start-ups are increasingly active in semiconductor R&D, focusing on next-gen fields like 5G, IoT, automotive, AI/ML, and edge computing. Global companies including Qualcomm, NXP, and Synopsys run major chip design centers in India, further fueling innovation capacity and creating a bridge to “design-to-manufacture” future leadership.

Key Challenges and Hurdles to Global Leadership

While the progress is robust, India’s path to semiconductor stardom faces significant headwinds:

1. High Entry Barriers: Capital, Tech, and Infrastructure

- Capital Intensity: Setting up advanced node fabs (5nm/7nm) requires billions in investment, cutting-edge expertise, and access to leading photolithography and equipment suppliers.

- Infrastructure: Chip plants need uninterrupted power, ultra-pure water, cleanroom facilities, and resilient logistics areas where India still has ground to cover compared with Taiwan or Korea.

- Supply Chain Dependence: India currently imports almost all semiconductor-grade materials and equipment, although current policy aims are to localize more of this value chain by encouraging suppliers like Merck and Applied Materials to set up Indian units.

2. Talent and R&D Gaps

- Skilled Middle Management: While India has a massive engineering talent pool, real-world fab and packaging expertise remains in short supply.

- R&D Funding: Even with new incentives, India’s overall chip R&D spend public and private lags far behind giants like the US and China.

3. Global Competition

Competing nations have ramped up their semiconductor ambitions:

- The US’s CHIPS Act offers $52 billion in incentives

- China’s National IC Fund exceeds $47.5 billion

- EU Chips Act and Japan’s $8.6 billion incentive packages pose further competition

India’s budgetary support while significant is still less than the deep-pocketed, mature markets it seeks to rival.

Outlook: Can India Succeed?

What’s Working

- Unprecedented Investment: According to the India Electronics and Semiconductor Association, investments committed in India’s chip sector now rival those in any other major new entrant globally.

- Rising Demand: Domestic consumption projected to cross $100 billion by 2030 creates a strong foundation.

- Geopolitical Tailwinds: US, Japan, and EU interest in diversifying supply chains aligns in India’s favor.

- Talent Pipeline: India’s design and engineering hub status gives it a real edge in upstream innovation and hybrid design-manufacture business models.

What Must Improve

- Fast-Track Advanced Node Fabs: India needs to attract more ASML-class equipment and proven tech partners for <10nm fabs to compete at the bleeding edge.

- Deeper Supply Chain Localization: Material, equipment, and skilled maintenance supplier clusters must scale up rapidly.

- Continued Export Orientation: Policies must remain globally competitive to anchor India’s place in worldwide value chains.

Expert and Industry Perspective

S Krishnan, Secretary, Ministry of Electronics and IT, stated at SEMICON India 2025, “Companies worldwide are keen on India’s potential not only to produce semiconductors but to be a sizeable market for the industry”. Design-led manufacturing, innovation-driven policies, and strong state-level coordination could make India a linchpin for the world’s rebalanced chip supply chains.

Conclusion

India’s semiconductor mission is already transforming the nation’s technological and economic future. With over $10 billion in incentives, surging domestic consumption, and a thriving chip-design workforce, India stands poised to become a major global semiconductor hub even if not yet a full-fledged rival to Taiwan, Korea, or the US. The path forward will be determined by policy continuity, further upskilling, export competitiveness, and, most crucially, how quickly India can ramp up world-class manufacturing and ecosystem depth.

As per latest industry data, India’s semiconductor market could top $100 billion by 2030 making its rise not just possible, but increasingly probable for those who bet on the Indian chip story.