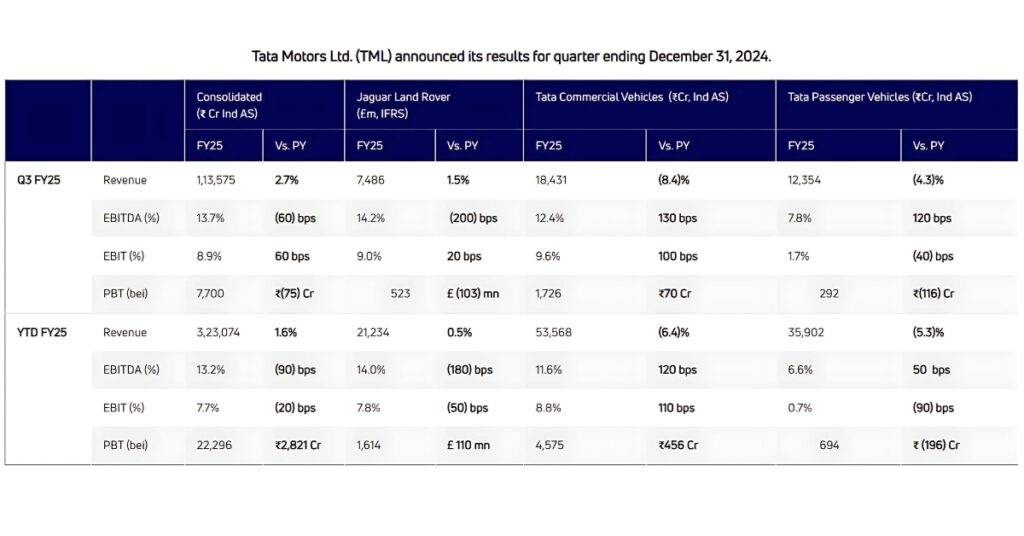

Tata Motors has announced its Q3 FY25 financial results, marking a significant quarter of growth across its operations, despite facing external challenges. The company posted consolidated revenues of ₹113.6K Cr, up by 2.7%, with an EBITDA margin of 13.7%. While the third-quarter performance showed sequential improvements, there were notable shifts across its key brands, including Jaguar Land Rover (JLR), Tata Commercial Vehicles (Tata CV), and Tata Passenger Vehicles (Tata PV). Below is a detailed breakdown of the brand-by-brand performance and the insights shared by the Tata Motors leadership.

Tata Motors Consolidated Overview

Tata Motors’ consolidated revenues for Q3 FY25 were ₹113.6K Cr, reflecting a growth of 2.7% compared to the previous year. Despite challenges, the company showed resilience, improving its EBIT by 60bps to 8.9%. The improvement came largely from easing supply chain disruptions seen in Q2 FY25. The company also posted a robust PBT (bei) of ₹7.7K Cr for Q3 FY25, a slight decline of ₹75 Cr from the previous quarter. Net Profit stood at ₹5.6K Cr.

For the YTD FY25 period, Tata Motors reported a strong PBT (bei) of ₹22.3K Cr, reflecting a growth of 14.5%. “In Q3, the performance of all businesses improved sequentially,” said PB Balaji, Group Chief Financial Officer of Tata Motors. “For YTD FY25, our business grew 1.6% over the previous year to ₹323.0K Cr and delivered a robust PBT (bei) of ₹22.3K Cr (+14.5%). The fundamentals of the business are strong and therefore despite external challenges, we are confident of delivering another strong performance this year.”

Jaguar Land Rover (JLR): Record Revenue & Highest EBIT Margin in a Decade

Jaguar Land Rover (JLR) delivered a stellar performance in Q3 FY25, with record revenues of £7.5 billion, an increase of 1.5% compared to the same period last year. The brand saw the highest EBIT margin in a decade, achieving 9.0%, up 20bps from the previous year. This marks JLR’s ninth consecutive profitable quarter. EBITDA for the quarter stood at 14.2%, a slight dip of 200bps year-on-year, driven by higher costs and some unfavorable FX revaluation.

Adrian Mardell, JLR’s Chief Executive Officer, commented: “JLR has delivered a robust performance in the third quarter of our financial year, and further milestones in our Reimagine strategy. Thanks to our people and partners, we achieved record revenue and our best EBIT margin in a decade, and our electrification plans are progressing.”

JLR’s performance was bolstered by a sequential growth in revenue, up 16% from Q2 FY25, primarily driven by higher wholesales after supply disruptions were resolved. The brand’s cash balance was recorded at £3.5 billion, with net debt at £1.1 billion. Furthermore, JLR’s circularity lab is making strides in sustainability, having delivered the industry’s first recycled seat foam proof of concept, aimed at reducing emissions and waste.

Looking forward, JLR remains focused on its electrification strategy, with the Range Rover Electric in development and a growing waiting list of 57,000 customers. “Our electrification plans are progressing, with the Range Rover Electric development continuing and sales of our plug-in hybrid models growing by 163% YoY in Q3,” Mardell added.

Tata Commercial Vehicles (Tata CV): Sequential Growth with Strong Margins

Tata Commercial Vehicles (Tata CV) posted revenues of ₹18.4K Cr for Q3 FY25, a decline of 8.4% compared to the previous year. Despite the decline, the brand’s EBITDA margin showed significant improvement, rising to 12.4%, an increase of 130bps. This was primarily driven by savings in material costs and the impact of the Production Linked Incentive (PLI) scheme. EBIT margin improved by 100bps to 9.6%. The company’s free cash flow for the automotive segment stood at ₹4.7K Cr.

Girish Wagh, Executive Director of Tata Motors Ltd, shared his thoughts on the quarter’s performance: “In Q3 FY25, HCV segment witnessed robust sequential recovery, even as the YoY sales declined 9% due to limited growth in end-use segments. The ILMCV segment and passenger carrier segment witnessed ~3% and ~30% YoY growth, whereas the SCV segment experienced marginal decline due to ongoing financing challenges. The business has delivered strong EBITDA and EBIT margin of 12.4% and 9.6%, respectively, with cost control and reflecting PLI incentive.”

The company also introduced several innovative products at the Bharat Mobility Expo 2025, including the Prima E.55S, a battery electric prime mover, and the Prima H.28, an indigenously developed hydrogen-powered ICE truck. Tata CV’s focus remains on driving innovation, with the introduction of over 50 product variants in Q3 FY25 alone.

Looking ahead, the commercial vehicle business expects demand to improve in Q4 FY25, driven by government infrastructure spending and growth in end-use segments. The company is also focused on reducing the impact of cyclicality in the sector and delivering strong margins and return on capital employed (ROCE).

Tata Passenger Vehicles (Tata PV): Resilient Growth Amid Market Challenges

Tata Passenger Vehicles (Tata PV) experienced a slight decline in revenue for Q3 FY25, down 4.3% to ₹12.4K Cr. Despite this, the brand showed solid improvements in EBITDA margin, which rose by 120bps to 7.8%, thanks to cost control measures and the benefits of the PLI scheme. EBIT margin, however, decreased by 40bps to 1.7%, reflecting the challenges in the passenger vehicle sector.

Shailesh Chandra, Managing Director of Tata Motors Passenger Vehicles and Electric Mobility, stated: “In Q3 FY25, we recorded wholesales of 140K units (1.1% growth over Q3 FY24) and retail sales growth of 6% over Q3 FY24. This has allowed us to sharply reduce our channel inventory ahead of Q4 FY25. In the EV segment, we registered 19% growth in the domestic personal segment, although our fleet volumes declined YoY due to the expiry of the FAME II subsidy.”

Tata PV continued to show leadership in the EV space, with an impressive 61% market share in the electric vehicle segment for YTD FY25. Additionally, the brand’s alternative powertrains strategy saw continued growth, with EV penetration reaching 11% and CNG at 24%.

The brand also made waves with the launch of several new products, including the 2025 Tiago, Tiago.ev, and Tigor, as well as exciting editions like the Stealth and Bandipur editions of its SUV range. Tata PV’s bold new product portfolio was showcased at the Bharat Mobility Expo, including the reimagined Tata Sierra and the Harrier.ev, marking the next phase of the company’s electrification journey.

Looking ahead, Tata PV is optimistic about moderate growth in FY25, bolstered by strong demand for SUVs and sustainable powertrains. With an ongoing focus on new product launches and expanding its EV portfolio, the company is well-positioned for further growth in the coming years.

Financial Highlights and Outlook

Tata Motors reported a reduction in finance costs by ₹760 Cr to ₹1,725 Cr for Q3 FY25, driven by a reduction in gross debt during the period. The company’s free cash flow for the automotive segment reached ₹4.7K Cr, marking a positive turnaround.

Looking ahead, Tata Motors remains confident in its growth trajectory. PB Balaji, CFO, concluded, “We expect underlying domestic demand to improve gradually on account of infrastructure spends, a slew of exciting product launches, and stable interest rates.”

With continued innovation, a strong focus on electrification, and an expanding product portfolio, Tata Motors is poised to maintain its positive momentum through the remainder of FY25 and beyond.

Tata Motors’ Q3 FY25 results demonstrate solid progress across its key brands, with JLR leading the way in profitability and Tata CV and Tata PV showing resilience amid market fluctuations. The company’s strategic focus on electrification, innovation, and cost control continues to drive its success, positioning Tata Motors as a formidable player in the automotive industry as it moves into the final quarter of FY25.

- India’s Push to Become a Global Semiconductor Innovation Hub: Can It Succeed?

- Dr. Laila Mintas Joins Board of Rules X, Operating Partner of European T20 Premier League

- Q-Commerce Rider Experience Gets Real – Aum Vats (@aumvats) Breaks It Down

- Lok Sabha Passes Waqf (Amendment) Bill 2025: Key Details and Reactions

- The Rise of Tier-2 City Startups in India: A New Frontier Beyond Metros